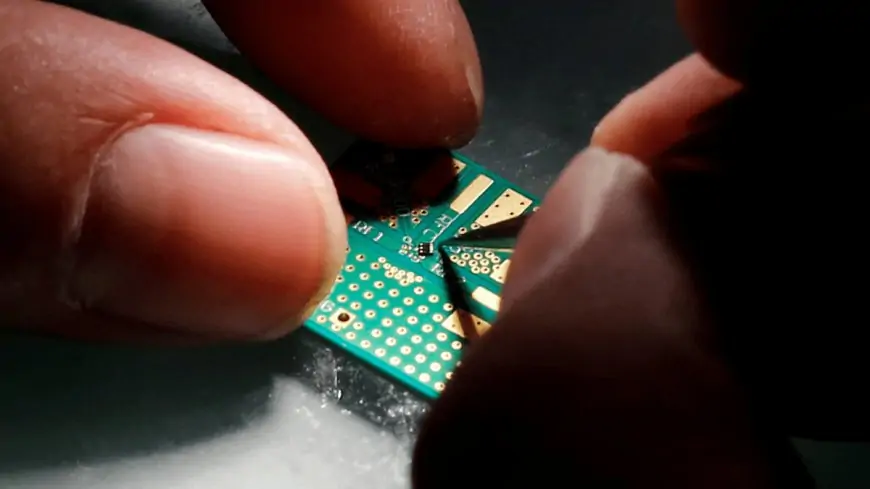

Because the US financial system rebounds from its pandemic droop, an important cog is briefly provide: the pc chips that energy a variety of merchandise that join, transport, and entertain us in a world more and more depending on expertise.

The scarcity has already been rippling via numerous markets since final summer time. It has made it tough for faculties to purchase sufficient laptops for college students compelled to study from residence, delayed the discharge of well-liked merchandise such because the iPhone 12, and created mad scrambles to seek out the most recent online game consoles such because the PlayStation 5.

However issues have been getting even worse in current weeks, notably within the auto {industry}, the place factories are shutting down as a result of there aren’t sufficient chips to complete constructing automobiles which might be beginning to appear to be computer systems on wheels. The issue was not too long ago compounded by a grounded container ship that blocked the Suez Canal for practically per week, choking off chips headed from Asia to Europe.

These snags are more likely to frustrate customers who can’t discover the automobile they need and typically discover themselves settling for lower-end fashions with out as many fancy digital options. And it threatens to depart an enormous dent within the auto {industry}, which by some estimates stands to lose $60 billion (roughly Rs. 4.4 lakh crores) in gross sales throughout the first half of his yr.

“We have been hit by the perfect storm, and it’s not going away any time soon,” stated Baird expertise analyst Ted Mortonson, who stated he has by no means seen such a severe scarcity in practically 30 years monitoring the chip {industry}.

Is the pandemic guilty?

Type of. The pandemic prompted chip factories to begin shutting down early final yr, notably abroad, the place nearly all of the processors are made. By the point they began to reopen, that they had a backlog of orders to fill.

That wouldn’t have been as daunting if chipmakers weren’t then swamped by unexpected demand. As an example, nobody entered 2020 anticipating to see a spike in private laptop gross sales after practically a decade of regular decline. However that’s what occurred after authorities lockdowns compelled tens of millions of workplace staff to do their jobs from residence whereas college students principally attended their lessons remotely.

Are different components at work?

Sure. Each Sony and Microsoft have been making ready to launch extremely anticipated next-generation online game consoles for his or her PlayStation and Xbox manufacturers, respectively, that required extra subtle chips than ever. So as to add to the demand, wi-fi community suppliers are clamoring for chips to energy ultrafast 5G companies being constructed around the globe.

President Donald Trump’s commerce struggle with China in all probability didn’t assist both. Some analysts imagine the Trump administration’s blacklisting of Huawei prompted that main maker of smartphones to construct an enormous stockpile of chips because it braced for the crackdown.

Why is the auto {industry} being hit so exhausting?

Keep-at-home orders drove a surge in shopper electronics gross sales, squeezing auto elements suppliers who use chips for computer systems that management fuel pedals, transmissions, and contact screens. Chipmakers compounded the stress by rejiggering manufacturing unit strains to raised serve the consumer-electronics market, which generates way more income for them than autos.

After eight weeks of pandemic-induced shutdown within the spring, automakers began reopening factories sooner than that they had envisioned. However then they have been hit with surprising information: chip makers weren’t capable of flip a change shortly and make the kinds of processors wanted for vehicles.

How are automakers coping with the scarcity?

They’ve canceled shifts and briefly closed factories. Ford, Normal Motors, Fiat Chrysler (now Stellantis), Volkswagen, and Honda appear to have been hit the toughest. Others, most notably Toyota, aren’t being affected as dramatically. That's in all probability as a result of Toyota was higher ready after studying how sudden, surprising shocks can disrupt provide chains from the huge earthquake and tsunami that hit Japan in 2011, stated Financial institution of America Securities analyst Vivek Arya.

The harder-hit automakers have diverted chips from slower-selling fashions to these in excessive demand, resembling pickup vehicles and huge SUVs. Ford, GM, and Stellantis have began constructing automobiles with out some computer systems, placing them in storage with plans to retrofit them later.

GM expects the chip scarcity to price it as much as $2 billion (roughly Rs. 14,000 crores) in pre-tax earnings this yr from misplaced manufacturing and gross sales. Ford is bracing for the same blow. Chipmakers in all probability received’t totally meet up with auto-industry demand till July on the earliest.

How will this have an effect on individuals who need to purchase a brand new automotive?

Anticipate to pay extra. Provides of many fashions have been tight even earlier than the chip scarcity as a result of automakers have been having bother making up for manufacturing misplaced to the pandemic.

IHS Markit estimates that from January via March, the chip scarcity lowered North American auto manufacturing by about 100,000 automobiles. In January of final yr, earlier than the pandemic, the US auto {industry} had sufficient automobiles to provide 77 days of demand. By February of 2021, it was down nearly 30 p.c to 55 days.

Will different well-liked merchandise be affected this yr?

Samsung Electronics, one of many world’s largest chipmakers, not too long ago warned that its huge lineup of shopper electronics could possibly be affected by the scarcity. With out specifying which merchandise may be affected, Samsung co-CEO Koh Dong-jin advised shareholders {that a} “serious imbalance” between the provision and demand for chips may harm gross sales from April via June.

What’s going to stop this from occurring once more?

There are not any fast fixes, however chipmakers seem like gearing as much as meet future challenges.

Intel, which for many years has dominated the marketplace for PC chips, not too long ago made waves by saying plans to speculate $20 billion (roughly Rs. 1.4 lakh crores) in two new factories in Arizona. Much more vital, Intel revealed stated it's beginning a brand new division that may enter into contracts to make chips tailor-made for different corporations along with its personal processors. That’s a serious departure for Intel, aligning it extra intently with a mannequin popularized by Taiwan Semiconductor Manufacturing Co., or TSMC, which already had been constructing a plant in Arizona, too.

Compelled by the present scarcity, TSMC additionally has dedicated to spending $100 billion (roughly Rs. 7.3 lakh crores) throughout the subsequent three years to broaden its worldwide chip manufacturing capability. About $28 billion (roughly Rs. 2 lakh crores) of that funding will come this yr to spice up manufacturing at factories which were unable to maintain up with the surge in demand for the reason that pandemic started, in keeping with TSMC Chief Govt Officer C.C. Wei.

And President Joe Biden’s $2 trillion (roughly Rs. 147 lakh crores) plan to enhance US infrastructure consists of an estimated $50 billion (roughly Rs. 3.6 lakh crores) to assist make the nation much less reliant on chips made abroad. The US share of the worldwide chip manufacturing market has declined from 37 p.c in 1990 to 12 p.c right this moment, in keeping with Semiconductor Business Affiliation, a commerce group.

However chips received’t begin popping out of any new factories constructed as a part of the spending splurge for 2 to 3 years. And at the same time as current factories ramp up and broaden to satisfy present demand, some analysts surprise if there may be a glut of processors a yr from now.

Orbital, the Devices 360 podcast, has a double invoice this week: the OnePlus 9 sequence, and Justice League Snyder Lower (beginning at 25:32). Orbital is obtainable on Apple Podcasts, Google Podcasts, Spotify, and wherever you get your podcasts.

![[WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral [WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral](https://www.sociallykeeda.com/uploads/images/202403/image_140x98_660976c59cce0.webp)

![[FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media [FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media](https://www.sociallykeeda.com/uploads/images/202405/image_140x98_6651e7ae8038d.webp)