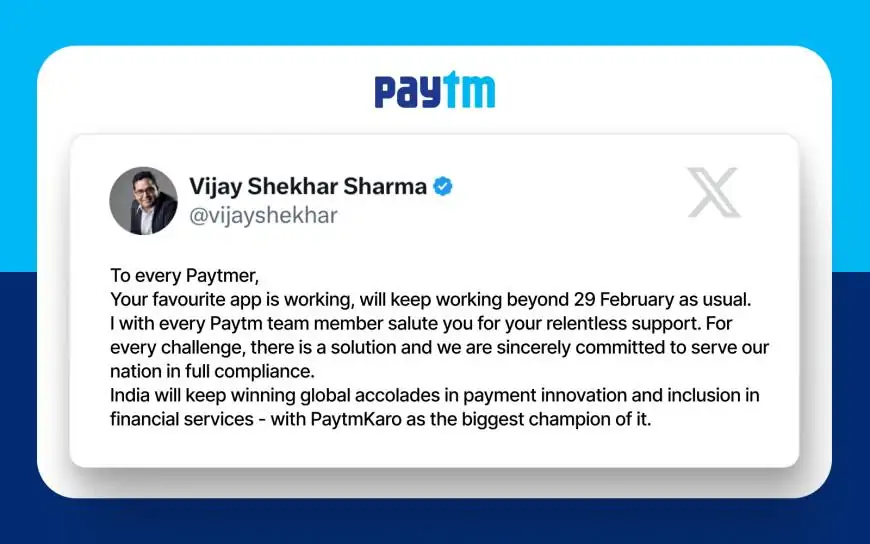

Your favored – Paytm app is running, and could maintain working past 29 February as usual. We are clearly devoted to serving our country. “To each Paytmer, Your favourite app is working and could maintain operating past 29 February as common. I with every Paytm crew member salute you to your relentless aid. For each task, there may be a solution and we're definitely committed to serve our nation in complete compliance. India will keep winning worldwide accolades in payment innovation and inclusion in financial services – with PaytmKaro as the most important champion of it,” our Founder & CEO Vijay Shekhar Sharma Tweeted.

Let’s clear the air and get the information right!

What takes place to heaps of shopkeepers who've sold Paytm devices?

Myth: The Paytm app will close?

Fact: Our Paytm app and its services keep to remain operational. Most of the services presented by using Paytm are in partnership with various banks and no longer simply our associate bank – Paytm Payments Bank Limited. We have constantly been at the leading edge of the virtual revolution in India subsidized via our huge navy of merchants and clients.

Will Paytm’s offline service provider price network offering preserve

Myth: Offerings like Paytm QR, Paytm Soundbox, Paytm Card Machine will stop?

Fact: Our service provider fee services will no longer be impacted. Paytm’s offline merchant fee network services like Paytm QR, Paytm Soundbox, Paytm Card Machine, will preserve as regular, wherein it can onboard new offline merchants as well.

We began our adventure of working with different banks during the last two years, which we will now boost up. The next section of our journey is to maintain to enlarge our bills and monetary services commercial enterprise, handiest in partnerships with other banks. Read our exchange submitting here.

Will Paytm can’t be used for UPI after Feb 29th?

Myth: Paytm will forestall UPI & all banking services?

Fact: Our Paytm app and its services preserve to remain operational. The Paytm UPI deal with will hold with out interruption till February 29, 2024. Clarifying similarly our Founder & CEO “On UPI obtaining, it wishes guidance from both the NPCI and RBI and the discussions have commenced. So what and how will they appropriately manual us, we are able to adhere to that,” Our President & COO introduced.

Meanwhile, our Founder & CEO Vijay Shekhar Sharma confident: “We may be running handiest with different banks, and not with the PPBL. The next phase of our journey is to maintain to enlarge our payments and financial services enterprise, simplest in partnerships with different banks. We offer obtaining services to traders in partnership with numerous main banks in the us of a and could keep to amplify 1/3-birthday party financial institution partnerships.”

He also brought: “We, as a payments agency, paintings with diverse banks (not simply Paytm Payments Bank), on numerous payments merchandise. We had been working with different banks when you consider that the start of the embargo. We now will boost up the plans and absolutely move to other bank partners.”

What will take place to Paytm Payments Bank FASTag?

Myth: Savings bills, Wallets, FASTags, and NCMC debts will be Impacted

Fact: There won’t be any impact on user deposits in their Savings money owed, Wallets, FASTags, and NCMC money owed, and they can hold to apply the existing balances. “After February 29, they can't add incremental money. OCL as a charge aggregator already works with numerous different banks and fee banks are one of the key banks,” our CEO clarified.

The customers can continue to use their present stability in your Paytm FASTag. We are running on powerful solutions to make sure a seamless client experience past this date and could maintain you updated. The directives from RBI are on Paytm Payments Bank (PPBL) and not on Paytm.

Are Paytm Mutual Funds and Paytm Money inventory accounts secure?

Myth: Will this have any detrimental impact on the users of @PaytmMoney?Fact: Our customers’ investments with Paytm Money are also safe. The current RBI directives on our accomplice bank won’t affect Paytm Money Ltd (PML) operations or their investments in Equity, Mutual Funds, or NPS. Paytm Money Limited is SEBI-regulated and absolutely compliant.

![[WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral [WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral](https://www.sociallykeeda.com/uploads/images/202403/image_140x98_660976c59cce0.webp)

![[FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media [FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media](https://www.sociallykeeda.com/uploads/images/202405/image_140x98_6651e7ae8038d.webp)