Shares of J2 Worldwide (NASDAQ:JCOM) elevated by 3.37% prior to now three months. Before we take a look at the significance of debt, let’s check out how a lot debt J2 Global has.

J2 Global’s Debt

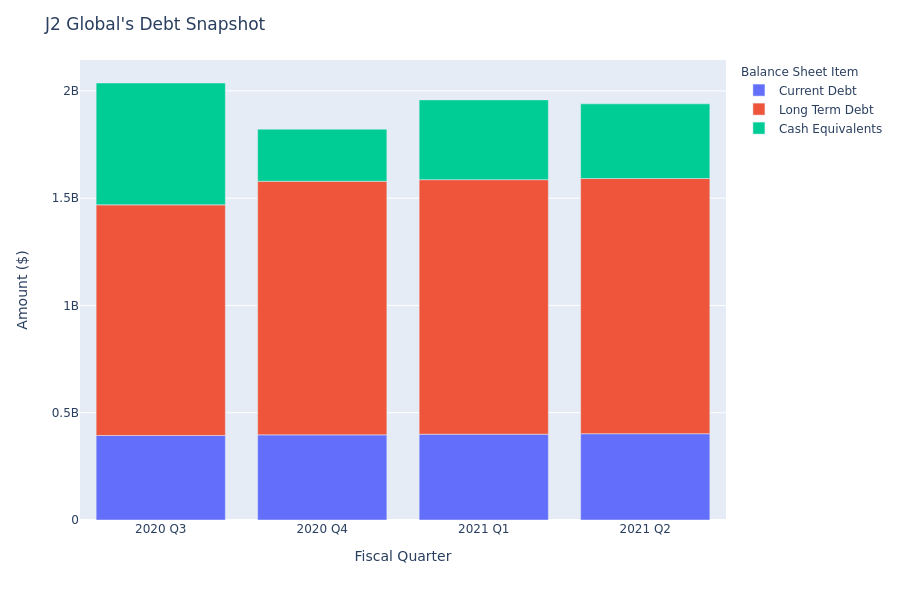

Based on J2 Global’s stability sheet as of August 9, 2021, long-term debt is $1.19 billion and present debt is $402.13 million, representing a complete debt of $1.59 billion. Adjusted for $347.86 million in money equivalents, the corporate’s internet debt is $1.24 billion.

???????? Free Movies and Free TV Shows! ????????

Let’s outline a number of the phrases we used within the part above. Short-term debt is the portion of an organization’s debt that's due inside 1 12 months whereas long-term debt is the portion that's due over greater than 1 12 months. Cash equivalents embrace money and all liquid securities with a maturity of 90 days or much less. Total debt is the same as present debt plus long-term debt minus money equivalents.

To perceive an organization’s diploma of economic leverage, traders take a look at its debt ratio. Taking into consideration J2 Global’s whole property of $3.70 billion, the debt ratio is 0.43. As a rule of thumb, a debt ratio of a couple of signifies that a good portion of debt is financed by property. A better debt ratio may additionally imply that the corporate is placing itself in danger if rates of interest had been to rise. However, debt ratios fluctuate extensively in several sectors. A debt ratio of 40% could also be increased for one sector and common for one more.

Why do traders take a look at debt?

In addition to fairness, debt is a vital consider an organization’s capital construction and contributes to its development. Due to its decrease borrowing prices in comparison with fairness, it turns into a beautiful possibility for executives making an attempt to lift capital.

However, because of curiosity fee obligations, an organization’s money move will be affected. Financial leverage additionally permits firms to make use of extra capital for enterprise operations, permitting fairness homeowners to retain the surplus revenue generated by the debt capital.

Looking for shares with a low debt-to-equity ratio? Check out Benzinga Pro, a market analysis platform that provides traders near-instantaneous entry to dozens of inventory metrics, together with the debt-to-equity ratio. Click right here to be taught extra.

![]()

![]()

For extra replace keep tuning on: sociallykeeda.com

Disclaimer: We at www.sociallykeeda.com request you to have a look at movement footage on our readers solely with cinemas and Amazon Prime Video, Netflix, Hotstar and any official digital streaming firms. Don’t use the pyreated web page to acquire or view on-line.

![[WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral [WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral](https://www.sociallykeeda.com/uploads/images/202403/image_140x98_660976c59cce0.webp)

![[FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media [FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media](https://www.sociallykeeda.com/uploads/images/202405/image_140x98_6651e7ae8038d.webp)