A bellwether semiconductor value is now half its July 2018 peak.

Three of the important thing supply-side elements driving right now's international inflation ranges have already rotated, which means aid could possibly be on the horizon for consumers worldwide.

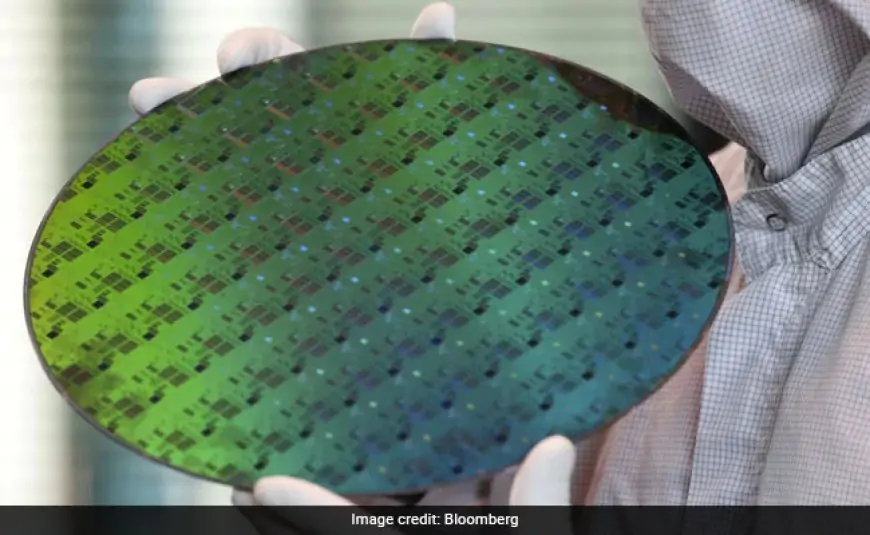

A bellwether semiconductor value -- a barometer of prices of completed electronics merchandise as numerous as laptops, dishwashers, LED bulbs, and medical units delivered worldwide -- is now half its July 2018 peak and down 14% from the center of final 12 months.

The spot charge for transport containers -- which tells us more about bills we are able to count on later within the pipeline for attire in Chicago, luxurious gadgets in Singapore or house furnishings in Europe -- has declined 26% since its September 2021 all-time excessive.

North America's fertilizer costs -- an indicator of the place international meals inflation goes, together with payments for tomatoes in London or onions on the market in a Johannesburg market -- is 24% under its file excessive in March.

With inflation now exceeding 8% within the euro space, anticipated to remain above that stage within the US when May information comes out on Friday and on the march in Asia too, central bankers around the globe are scrambling to comprise it.

Even as central bankers elevate charges, more economists are coalescing round the concept peak inflation is behind us -- although there will likely be a lag earlier than the decrease prices of uncooked supplies filter by means of to the costs consumers see.

Though few forecasters are predicting a return to pre-pandemic costs within the brief run, international retail giants like Walmart Inc. at the moment are struggling to unload bloated stock to a much less enthusiastic shopper. So a moderation in these supply-side pressures may finally permit central bankers to sluggish their tightening cycles.

“While inflation in some parts of the world are yet to peak, there are at least some signs emerging that we may not be too far off in terms of a turning point at which we start to see the annual inflation rate start to head lower,” stated Khoon Goh, Singapore-based head of Asia analysis at Australia & New Zealand Banking Group.

China's producer costs peaked in late 2021 and are starting to reasonable. Economists are forecasting a 6.5% rise in manufacturing facility costs in May from a 12 months earlier, down from 8% in April.

That's a promising improvement for aid in imported-goods inflation worldwide, stated Goh. In addition, decrease container freight charges and enhancing provider supply occasions in buying managers indexes level to easing bottlenecks that ought to curb value pressures later this 12 months, he stated.

![[WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral [WATCH VIDEO] Sophie Rain and sister Sierra Rain as Black Spiderman goes viral](https://www.sociallykeeda.com/uploads/images/202403/image_140x98_660976c59cce0.webp)

![[FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media [FULL WATCH VIDEO] Will Levis And Gia Duddy Leak Video Viral On Social Media](https://www.sociallykeeda.com/uploads/images/202405/image_140x98_6651e7ae8038d.webp)