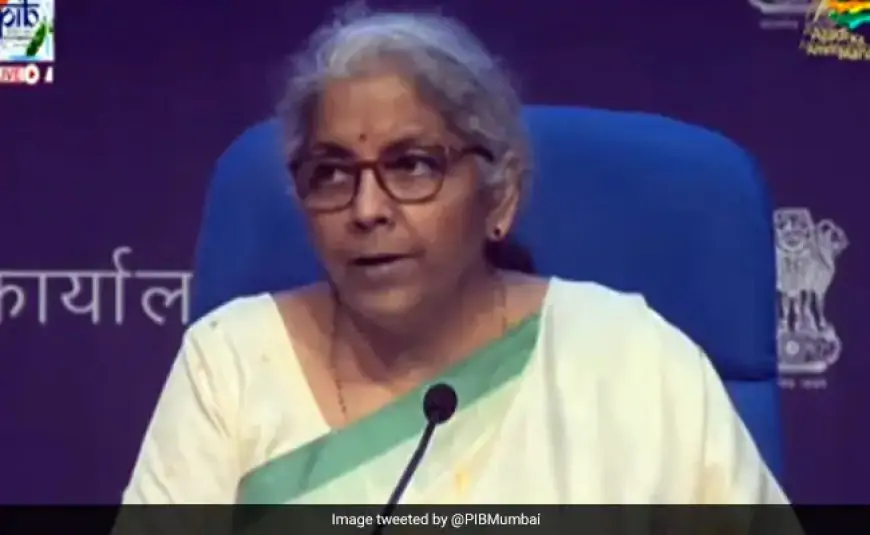

Finance minister Nirmala Sitharaman has defended the delay in submitting criticism in ABG Shipyard case

Finance minister Nirmala Sitharaman has defended the delay in submitting criticism in ABG Shipyard case

To stay updated with the latest bollywood news, follow us on Instagram and Twitter and visit Socially Keeda, which is updated daily.