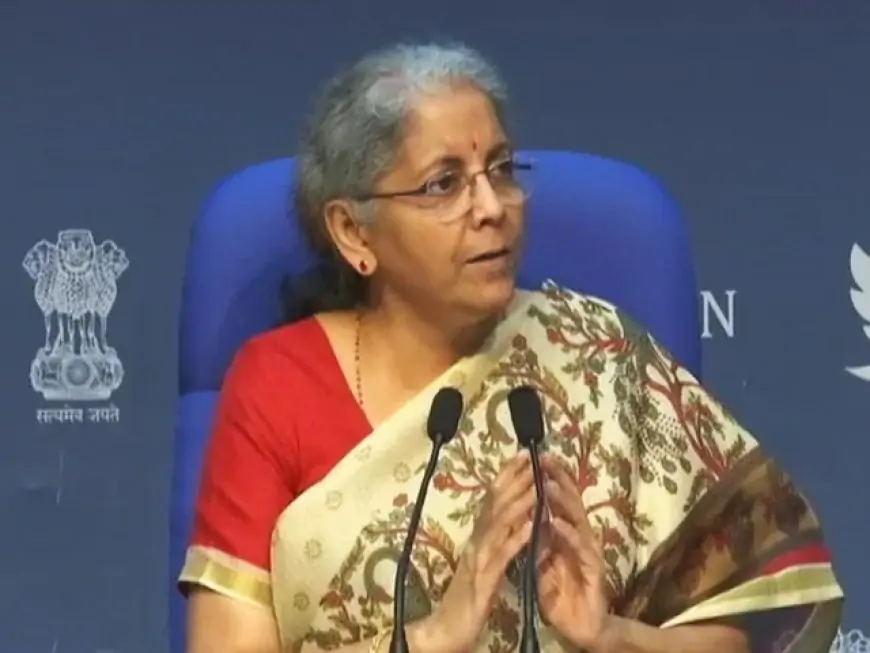

Finance Minister Nirmala Sitharaman will current Union Budget 2023-23 on February 1.

Finance Minister Nirmala Sitharaman will current Union Budget 2023-23 on February 1.

To stay updated with the latest bollywood news, follow us on Instagram and Twitter and visit Socially Keeda, which is updated daily.